♦ Hassle-Free Business Funding

♦ Minimum $10,000 monthly sales

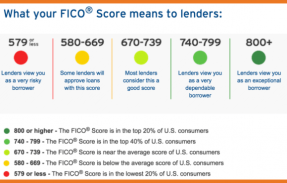

♦ Minimum 550 Personal Credit

♦ Multiple Offers From One Secure Application

♦ Same Day Approval & Funding

♦ SBA Loans in 45 days or less

♦ Business Term Loans

♦ Business Revolving Lines Of Credit

♦ Business Cash Advances

♦ Consolidation Loans including Merchant Cash Advances

Apply Securely Online And Get Funded Today

Applying Will Not Impact Your Credit Score

Call Us 845-765-8810

How Can We Help You Today?

![]()

Business owners want a relationship they can depend on and that’s why they come to us.

We are committed to understanding your business funding needs and providing you with excellent service.

We take the time to find out about your goals and offer financial solutions that fit your need.

Whether it’s a revolving line of credit, business cash advance, short-term business loan, consolidation, SBA business loan, Equipment Financing or some other type of business financing that you are looking for, we’re here to help you.

Give Us A Call at 845-765-8809 or 845-765-8810.

Or you can get simply begin by completing the form to the left.

How Our Small Business Cash Advance Programs Work

Fast and Secure access to Business Financing Cash Advances

We’ve simplified the process into 4 steps

Apply in minutes!

Complete Our Secure Online Application

Quick, Easy and Confidential.

Fast Same Day Approvals

Choose From Multiple Offers.

Same Day Funding

Cash Wired Into Your Business Bank Account.

Hassle-Free Affordable Repayment

Conveniently Debited From Your Business Account.

Why Us

We are business funding specialists and offer various programs for business cash advance / loans.

From start to finish we give fast, simple, and honest answers.

Since 2005, our knowledgeable business cash advance specialists have been working together with business owners to get them what is sometimes called: business cash advance loans and merchant loans.

Our job is to get you the right fit for your business funding needs and that’s just what we do. We’ll give you the Hassle-Free, Personalized Service that you’ve been searching for.

Fast and Convenient. Click Here To Apply Securely Online – Without Leaving Your Office.

Do You Need A Fast Business Cash Advance?

Whether it’s a Business Cash Advance, Merchant Cash Advance Loans, Short-Term Business Loan, an SBA loan, a Revolving Business Line of Credit or a Collateral based loan we have business funding options.

Bankruptcy, Tax Liens and Judgements Are OK.

Business Cash Advance

Apply for Business Cash Advance / Loans Now, You can get the funds you need quickly and easily, in as little as 3 days. Funds will be wired to your account within 24 hours.

Unsecured Business Term Loans

Unsecured Business Term Loans have an attractive advantage over traditional bank loans because it’s based on the cash flow of your business

Revolving Business Line of Credit

Get the security of a quick and flexible, true revolving business line of credit. Only pay for what you use. Take a draw whenever you want.

SBA Express Loans - 30 Days

SBA loans are the best deals going with rates as low as 6% and loans up to $5 million and 10 to 25 years monthly repayment terms.

Collateral Based Loans

Collateral Based Loans can be a great way to get an influx of cash to your business quickly and easily using the assets of your business.

These Programs Have Been Covered By: